KeBob – the first of its kind

A greater sense of well-being and safety in your branch.

KeBob is a digital, AI-based assistance system developed specifically to improve well-being, safety and security in semi-public spaces. KeBob is interactive thanks to the use of a pre-trained, artificial intelligence system that assesses situations in real time. Complemented by actuators, voice communication, and a face design, this interactive solution for digital AI assistance systems is unlike anything else on the market, helps your staff carry out their day-to-day duties in the branch, and improves everyone’s well-being in the foyer.

Strict data protection lies at the heart of KeBob. The solution is based on a local intelligence system that does not save or transfer any images or data. Instead, it analyzes video data directly, in real time, meaning the AI can respond immediately without the need for external analyses.

As an autonomous AI monitoring system, KeBob protects your bank branch against attacks on ATM machines (e.g., using explosives). It detects if anyone is still in the foyer, can identify suspicious people, and automatically activates security measures (such as shutters closing in front of the machines) and notifies security staff.

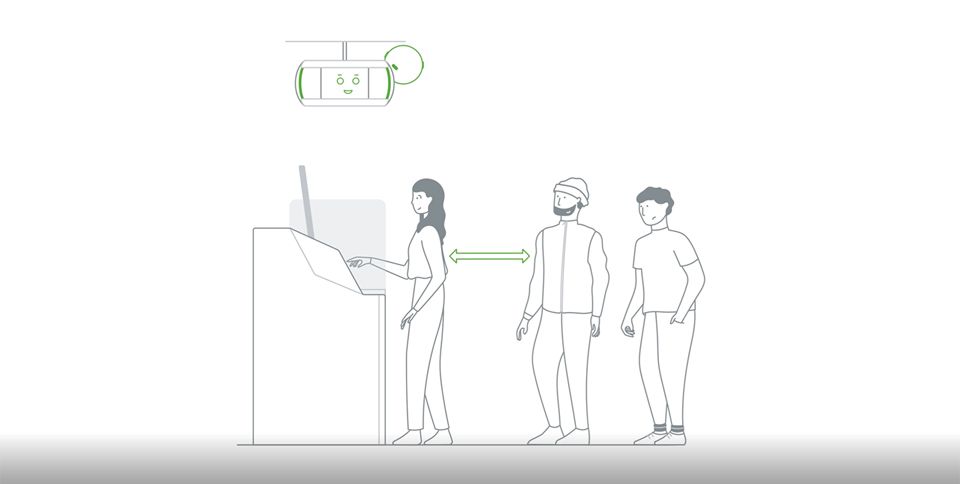

To protect people’s privacy, KeBob can ask people to stand further back when waiting at the ATM machine to prevent PIN numbers from being spied on, or can ask motorcyclists to remove their helmets. This not only improves well-being, it also gives people a greater sense of safety and security in your bank. KeBob detects people who have fallen or are in need of assistance and can request help. The AI solution also asks uninvited overnight guests to leave the foyer and ensures that nobody is trapped in the foyer by accident. With such a wealth of features, KeBob becomes a new, digital employee in the foyer, enabling you to provide a better banking experience.

Detects dangerous situations in real time

Automatically activates security measures

Addresses people directly, such as in a medical emergency

Get to know KeBob!

KeBob is KEBA's new AI assistance system for a more pleasant and secure banking experience.

It not only recognizes dangerous situations in real time and can activate security devices, but can also address people directly, e.g. in the event of medical emergencies or if too little distance is maintained at the ATM.

KeBob uses artificial intelligence to understand what people are doing in the foyer and assess the urgency of their actions, which improves safety, security, and people’s sense of well-being in self-service areas. This combination of features is unlike anything else on the market and has been tailored to the needs of bank branches. Thanks to its AI technology, KeBob can take care of certain services in the branch, helps to boost well-being, and eases the burden on your bank staff.

KeBob system overview

The KeBob assistance system comprises hardware components such as the KeBob Guard, KeBob Server, and various I/O modules. These are complemented by comprehensive software functionalities and a central management platform.

The infographic illustrates the KeBoB system in three layers:

-

Foyer

-

Back Office

-

KEBA Management Platform (Internet)

In the foyer, the KeBoB Guard and several cameras are installed. The Guard serves as a customer interface in the branch and consists of a display and a microphone. It is capable of addressing your customers in real time.

The devices in the foyer are connected to the server in the back office via a PoE switch. This server hosts both the artificial intelligence and the connection to the KEBA Management Platform. This platform enables:

-

monitoring and configuration of your KeBoB devices,

-

the provisioning of software patches and security-related updates,

-

as well as the sending of notifications, such as alerting a security service.

Thank you for your request. Our KEBA Customer Support will get in touch with you soon.